ABOUT VIETNAM

INTRODUCTION

With the amendment to Vietnam’s Housing Law which came into effect in July 2015, the country’s residential property market offers long term growth potential and immerses opportunities for foreign investors.

This guide aims to provide foreign investors with a quick overview of Vietnam’s legal framework as well as some key information on residential property investment in Vietnam.

ABOUT VIETNAM

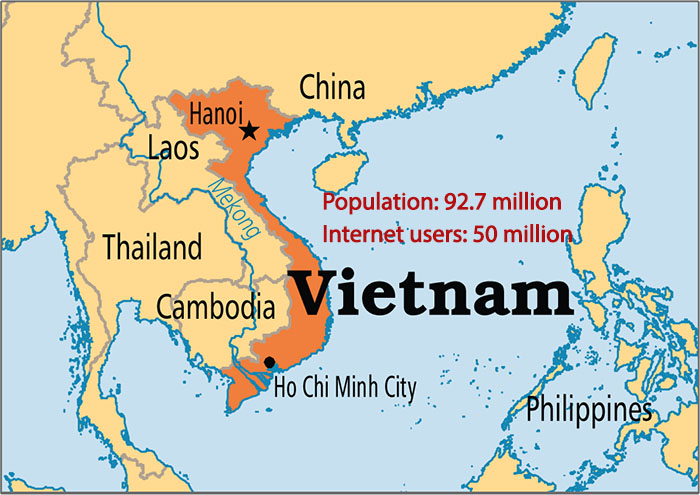

Vietnam lies in the heart of Southeast Asia and spans across 330,967 km2. It is home to over 90 million people with nearly 50% of the population below age of 30(1). The economic growth in recent years with GDP growth rate averaging 6.81% for year 2017 and 7.08% for H1.2018. The formation of ASEAN Economic Community and the passing of the CPTPP will provide a favorable setting for Vietnam’s economy and increase foreign investments into the country.

Vietnam GDP Growth

2010-2018

Vietnam GDP forecast up to 2020

INVESTMENT INDUSTRIES

Vietnam has become an attractive investment destination for various sectors, from manufacturing, real estate, energy, retail, and construction, to arts, tourism, entertainment, and other services. The investment in real estate sector accounted for 8.37% of total FDI inflows in 2017. Ho Chi Minh City, Hanoi, Da Nang, Nha Trang, Phu Quoc stands out as the hub to attract most of the large-scale real estate projects.

1.1. TOP REASON TO INVEST INPROPERTY IN VIETNAM

Capital appreciation: The property market’s long-term growth is highly potential, driven by the country’s stable political environment, promising economy, high urbanization rate and young population.

Affordability: High-end residential options with a full suite of complimentary facilities, good location, and convenient accessibility are very affordable, compared to its regional peers.

For Rental yields: With the increasing inflow of RENT foreign investment, more expatriates and local professionals are expected to relocate to Vietnam’s major cities, which promises good rental yields for homeowners.

Tourism paradise: A popular tourist destination with major ASEAN cities located within a 2-hour flight, Vietnam is an ideal place for vacationers and retirees.

1.2. VIBRANT HO CHI CHI MINH CITY – VIETNAM’S LARGEST CITY & ONE OF ASIA’S FATEST-GROWING CITIES

| Located in the South of Vietnam, Ho Chi Minh City (HCMC), formerly named Saigon, is one of the largest and most important cities in Vietnam. This city is not only a Centre of commerce and finance, but also Vietnam’s hub for science, culture, education and technology. With a young and dynamic population of over 8 million people and a growing middle class, HCMC has enormous market potential. The city boasts the best infrastructure in the nation including modern transportation and telecommunication systems to create modern well-planned city that can become the most desirable and international Business Centre in Southeast Asia. |

| Buying property in Ho Chi Minh City, Vietnam’s fastest growing city, has been a trend among local and foreign investors. Prime spots in Saigon such as the busy urban districts have been the focus of residential and commercial developments in the past few years. What makes property investment in Ho Chi Minh City attractive is that foreign investors can still find good locations to invest in that are affordable and will appreciate in value in the next several years. Major investments and infrastructure developments in Saigon will further the investment frenzy, that is why it’s the right time to invest in property while there are still a lot of premium and quality deals. |

1.3. HANOI – THE DYNAMIC CAPITAL OF VIETNAM

- Hanoi’s lucrative property market attracts foreigners. The Vietnamese capital Hanoi has emerged as a favored destination for foreign investors looking to the property market, as prices remain among the best value in Indochina, even as a gradual recovery has been underway since a disastrous slump rocked the housing market in 2007.

- Hanoi is the political and cultural center of Vietnam, the city has seen a rapid growth the past years, and it’s projected to grow even more the coming decades.

- Hanoi expects to attract more foreign buyers on its real estate market as a rising number of foreign experts and entrepreneurs are working in the capital city.

- Statistics show that more than 82,000 foreigners live and work in Vietnam, and a large number of them are in Hanoi from South Korea, China, Singapore, Russia and the US, reported the Vietnam News Agency.

- With a quickly growing population and increasingly bigger middle class, the locals help to drive up the demand as well. A long term investment in Hanoi will reap the yields.

HOME OWNERSHIP FOR FOREIGNERS

2.1. New Law on Housing

The Law provides regulatory conditions for residential property ownership in Vietnam. The new law which took effect on 1 July 2015 allows foreigners granted entry into Vietnam to buy residential properties in the country.

2.2. Land use rights

Private ownership of land is not recognized in Vietnam. Under

the laws, the Vietnamese hold all ownership rights with the State as the administrator on their behalf. However, the laws of Vietnam allow individual person or corporate entity to have ownership of a right to use land as the land user. Such right is calledthelanduseright(“LUR”). A building, house or apartment constructed on land may be owned where a person has a consolidated legal document called as “Certificate of Land Use Right and Ownership of House and Other Assets on the Land” (or in short as the “Pink Book”).

2.3. Eligibility

Foreign individuals: who are granted entry into Vietnam and not entitled to privileges and diplomatic immunity.Detailed documentation: valid passport affixed with an entry stamp by the immigration authority of Vietnam and such individual must not be in the category of people entitled to preferential treatment or diplomatic immunity.

Foreign entities: who are foreign invested enterprises, Branches and representative offices of foreign enterprises, foreign funds, and branches of foreign banks duly operating in Vietnam.Detailed documentation: an investment registration certificate or document proving permission to operate in Vietnam (both referred to as investment registration certificate or IRC) as issued by the competent agency of Vietnam and effective as at the time of entering into the residential housing attraction.

| 2.4. Rights & Protections |

| Foreign individuals granted Pink Books for their residential property in Vietnam will be entitled to ownership and use rights similar to the local Vietnamese, except for certain restrictions including purchase limit & ownership tenure (as discussed in Section 2.5 below). These rights include without limitations: o To use their houses for residential and other purposes not prohibited by law; o To maintain, renovate, demolish, or rebuild their houses in accordance with conditions and procedures of Laws on Construction; o To carry out real estate transactions on their properties such as selling, leasing, mortgaging, bequeathing, etc., in accordance with conditions and procedures of Laws on Real Estate Business; ü To receive the compensation in accordance with market price as prescribed in Laws when the State demolishes, purchases compulsorily, or commandeers their houses for the purposes of national defense and security, socio-economic development, disaster prevention, or in the state of wars or emergencies; and To file complaints, denunciation, or lawsuits over violations against their lawful ownership rights. üForeign entities can use their properties with similar rights as mentioned but only as accommodation available to their staff. Such rights are also subject to certain restrictions including purchase limit and ownership tenure (to be provided below). To clarify, foreign entities are not allowed to use their houses for business including sublease, offices for other purposes. ü Foreign homebuyers are not required to reside or work in Vietnam to be eligible for house ownership. ü Despite the difference in tenure of ownership for foreign and local homebuyers, there is no difference in the purchase price between a local and foreign purchaser. 2.5. Restrictions 2.5.1 Land tenure 2.5.2 Purchase limit 3. PURCHASING PROPERTY |

Note:

- As the guidance for the new Law on Housing is pending, transaction involving foreigners shall be conducted under the Long Term Lease Contract, which will be subsequently converted into Sales & Purchase Agreement if the purchasers are eligible, upon the issuance of the official guidance.

- Unit measurement: Selling price & management fee will be based on Net Usable Area (Carpet Area or Inner Area), which will also be clearly indicated in the Sales & Purchase Agreement (SPA). In general, Carpet Area is the area within the building and inclusive of areas taken by room-divided walls, balcony/loggia attached to the building. It excludes the area of external walls, columns, service ducts, and technical compartments.

* It’s standard apply but not fixed and depend on the sales policy of each Developer

4. PAYMENT

4.1. Quoted price for apartment units

Whether the quoted price is inclusive of Value Added Tax or Maintenance Fee should be clearly indicated in the Sales & Purchase Agreement:

Quoted Price = Apartment Price + Value Added Tax + Maintenance fee

Value Added Tax (VAT): Is usually 10% of the apartment value at the moment. VAT rate is subject to change in accordance with VAT laws. Maintenance Fee (or Sinking Fund): Before the handover of the unit, all apartment owners have to contribute 2% of the apartment price for the maintenance and major repairs of common areas in the apartment building. This Maintenance Fee is not used for the operation and management of the condominium, which will be covered by Management & Operation Fee.

4.2. Transaction Costs

Besides VAT and Maintenance Fees which have been included in the quoted price, real estate transactions often result in the following transaction costs:

Registration Tax (Upon registration for Ownership Certificate): 0.5% of the apartment value (capped at VND 500 mil.) and in the case of land residential property, 0.5% * land or house area * land price announced by the local people’s committee at the time of registration.

Notary’s Fees: Calculated based on the value of the property under transaction (from VND 1 mil. and capped at VND 10 mil.)

Personal Income Tax (PIT): Income gained from real estate transaction is taxable with tax rate fixed at 2% (of the selling price). Currently, tax laws in Vietnam allow PIT exemption in case the transfer is between immediate family members or the seller owns only one real property and meets other criteria.

(All these costs are subject to change in accordance with relevant laws and regulations)

4.3. Payment Methods

Foreign homebuyers can choose one of the following paying methods; (a) open a local bank account in Vietnam to transfer payments to the Developer’s bank account; (b) transfer payment directly from abroad to the developer’s bank account set up in Vietnam; or (c) make cash payment in VND to the developer’s bank account in Vietnam.

Please note that cross-border cash transfer and movement are strictly monitored in Vietnam, read more on Section 7.

4.4. Payment Scheme

The developers will decide the payment scheme, which will be clearly indicated in the SPA. Usually subject to negotiation between buyers and sellers, homebuyers can choose to pay in lump sum or to make milestone payments. For projects being under construction, the current Law on Real Estate Business sets the collection limit to 50% for foreign developers and 70% for local Vietnamese developers prior to the handover. Plus, they can only collect up to 95% of the home value before the clients receive the Ownership Certificate (Pink Book).

It is a common practice in Vietnam for:

+ The seller to bear the PIT;

+ The buyer to bear the Registration Tax;

+ Both parties to negotiate who will bear the remaining taxes and fees.

5. HANDOVER

5.1. Warranty & Insurance

Developers are required by laws to provide homebuyers warranty services for the house structures and equipment which malfunction or are damaged. The warranty period starts from handover date and must last at least 24-60 months depending on the property types. Warranty terms shall be clearly indicated in the sales and purchase agreement.

Developers are not bounded by law to offer homebuyers insurance for their purchased properties. Homeowners are recommended to arrange insurance for their property on their own.

5.2. Failure to deliver

Late handover may result in a compensation amount equal to the interest on the paid amounts to the buyer. The interest rate shall be equal to the lending rate at a commercial bank at the time of the late handover.

In case the developer cannot commit to the ultimate deadline for handover as stated in the SPA, the buyer has the right to unilaterally terminate the SPA. The buyer shall be refunded the full paid amount plus compensation amount as mutually agreed in the SPA.

5.3. After-sale costs

Management Fee will be paid monthly by the residents and used for the operation and management of the condominium. Services include, but are not limited to, elevator’s operation, security services, garbage collection, pest control, janitorial and gardening services, and maintenance of common facilities, etc. The monthly fee is calculated based on the carpet area.

Miscellaneous Fees such as utilities fees, parking fees, etc. will also subject to negotiation between residents and the developer.

6. SUBLEASING & TRANSFERRING PROPERTY

| 6.1. Subleasing property and tax obligation |

| Foreigners are allowed to sublease property, but they shall report to the district-level housing authority if he/she wishes to rent out property. Rental income is taxable. Tax rate will vary in accordance with the rental income. 6.2. Selling property & tax obligation Foreigners are allowed to sell property. If a homeowner with a valid Pink Book sells to another eligible foreigner the remaining tenure is pending the Government’s guidance. If the transferee is a Vietnamese, the tenure shall be automatically converted to Freehold. Personal income tax from sale of property is subject to 2% of the selling price. 6.3. Professional support The Foreign homeowners are encouraged to consult with professional brokerage firms or real estate agents who have experiences in property management, transactions, and leasing. Developer can refer some of these well-known consultants to the foreign homeowners.7. FINANCE 7.1. Movement of physical currency 7.2. Inward and outward remittances 7.3. Opening a bank account in Vietnam 8. “OWNERSHIP” OF LAND IN VIETNAM 8.1. “OWNERSHIP” OF LAND IN VIETNAM The laws of Vietnam vest ownership of land to the Vietnamese people and do not recognize private ownership of land by individuals and organizations. The State is responsible for the administration of land throughout Vietnam on behalf of the Vietnamese people. The State may grant rights to use land (“Land Use Rights” or “LUR”) in the form of land use rights certificates (“LUR Certificates”) to individuals and organizations by way of land allocation or lease. The relevant People’s Committees are authorized to supervise the use and management of land in their respective localities on behalf of the State. 8.2. Grant of land use rights 8.3. Land use duration 9. USEFUL SOURCES FOR REFERENCE (SRC: CAMIA) Please do not hesitate to contact us for consultancy regarding properties & property transactions in Vietnam: CENTURY 21 CAPITAL REALTY |