Foreign direct investment (FDI) into Vietnam is still in a slowing trend, but most likely, this is just a “calm” before a big wave.

FDI “Silence”

The statistics on the situation of attracting foreign investment, which the Foreign Investment Department (Ministry of Planning and Investment) has just announced, shows that FDI inflows into Vietnam are still in a slowing trend.

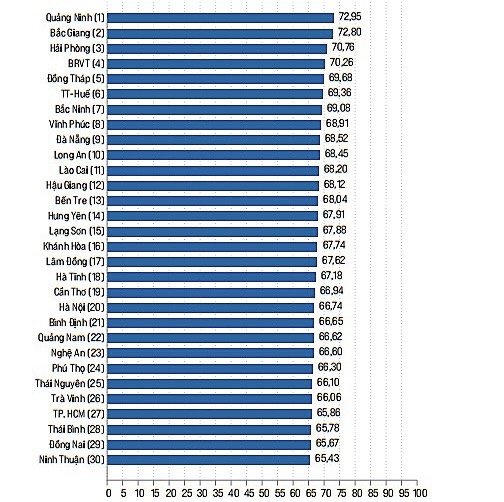

Specifically, as of February 20, 2023, the total foreign investment capital newly registered, adjusted and contributed capital to buy shares, purchase capital contribution of foreign investors reached nearly 3.1 billion USD, down 38% over the same period in 2022. Meanwhile, realized capital of FDI projects is estimated at 2.55 billion USD, down 4.9% over the same period in 2022. There is one positive point, according to Mr. Do Nhat Hoang, Director of the Foreign Investment Department, it is the new investment capital that has increased sharply in both the number of projects and the total registered capital. Accordingly, in the first two months of the year, 261 new projects were granted investment registration certificates, with a total registered capital of more than 1.76 billion USD, an increase of 42.6% in the number of projects and an increase of nearly 2. 8 times in terms of capital over the same period.

Newly registered capital increased not only because the number of projects increased, but also because the number of projects with registered capital over 100 million USD was more than the same period. In the same period last year, there was only 1 project with registered capital of over 100 million USD, while this year there are 4 projects. Notably, Fulian Precision Technology Factory Project (Singapore) in Bac Giang, registered capital of 621 million USD, with the goal of producing electronic components, computers.

Along with that, capital contribution and share purchase by foreign investors have also been improved. In the past 2 months, there were 440 times of capital contribution and share purchase by foreign investors (up 10% over the same period), with a total value of contributed capital of nearly 797.9 million USD (up 3.7% compared to the same period last year). same period).

In addition to positive information, data from the Foreign Investment Agency also showed that adjusted investment capital continued to decline sharply over the same period and fell deeper than in January 2023 because there were not many regulated projects. large capital adjustment. This is very remarkable, because last year, while new registrations decreased, adjusted capital increased and this is explained by foreign investors’ confidence in the investment, business and investment environment. potential of the Vietnamese market.

In the first two months of this year, only 133 projects registered to adjust their investment capital, with the total registered capital increased by nearly 535.4 million USD, down 6.3% in the number of projects and down to 85.1 % of capital over the same period.

According to the Foreign Investment Agency, not only the increase in the number of projects adjusted capital over the same period in January 2023 was no longer maintained in the first two months of the year, but the additional registered capital also decreased sharply.

In the first two months of last year, with a series of large-scale projects to increase capital, including Samsung Electro-mechanics Vietnam Project in Thai Nguyen, capital increased by 920 million USD; or the Factory Project of manufacturing electronic equipment, network equipment and multimedia audio products (Hong Kong), with an increase of nearly 306 million USD in Bac Ninh…, the additional FDI capital reached 3.6 billion USD, 2.2 times higher than in 2021. Meanwhile, this year, no major projects have been “named”.

The statistics of 2 months, which are the Tet months, with a long holiday, are not enough to reflect the general trend of the whole year, but also partly show that FDI attraction to Vietnam is in a “silent period”. “.

Waiting for the “big wave”

Although the statistics are not very positive, the affirmations from international partners say that Vietnam is a safe and attractive destination. A survey by the Japan Trade Promotion Organization (JETRO), or the European Business Association in Vietnam (EuroCham) both stated that, coming here, Japanese and European investors … will increase their investment in Vietnam. Vietnam. And in fact, there are still large-scale commitments made by the “big guys”.

Most recently, according to information from the Bangkok Post (Thailand), Central Retail Corporation announced that it will invest about 50 billion Baht (equivalent to 1.45 billion USD) in Vietnam in the period of 2023-2027 to open a business. expanding presence in the Vietnamese retail market. This is said to be the largest investment that Central Retail Corporation has poured into Vietnam so far.

Piaggio Group has just increased its investment capital in Vietnam for the 14th time. With a new investment of 75 million USD, Piaggio raised the total investment capital in Vinh Phuc to 165 million USD.

Another name – Goertek is readying new investments, after pouring about 1 billion USD to invest in factories in Bac Ninh and Nghe An. According to the plan, Goertek will invest an additional 290 million USD for the expansion of the factory in Bac Ninh in the near future.

In a report submitted to the Government not long ago, the Ministry of Planning and Investment said that global investment is facing many difficulties, due to tighter financial conditions and concerns about a global recession. However, in that context, Southeast Asia benefits from the supply chain shift from China, due to the US-China trade tension.

“Supply chain shifts are also accompanied by investment capital flows, leading to an increase in FDI into the ASEAN bloc, as businesses establish manufacturing plants, warehousing facilities, distribution networks and other businesses. other facilities in the region”, said the Ministry of Planning and Investment.

In ASEAN, Vietnam has an advantage. A recent survey by EuroCham said that a quarter of European companies surveyed had moved their operations from China to Vietnam. Of which, 2% have moved a significant part of their operations to Vietnam.

Survey results of the American Chamber of Commerce in Vietnam (AmCham) with American businesses in China, or a survey by JETRO on investment trends of Japanese enterprises show that Vietnam has many opportunities. festival. The Foreign Investment Agency also forecast that Vietnam’s FDI attraction in 2023 could increase by 30% compared to last year, reaching about 36-38 billion USD.

Although the opportunity is great, the competition is also getting fiercer. Therefore, suggestions on continuing to improve the investment and business environment have been made. One of the issues that is considered urgent is Vietnam’s policy response when many countries around the globe are ready to impose a global minimum tax from the beginning of 2024.

According to Mr. Thomas McClelland, Deputy General Director of Tax Advisory Services, Deloitte Vietnam, if Vietnam does not have reasonable and timely reforms on tax incentives, in the case of competitors Considering favorable investment incentives and measures to adapt to the global minimum tax, Vietnam may be “left behind” in attracting FDI.