Despite rising trade protectionism worldwide, Vietnam continues to set new export records and has emerged as the next manufacturing hub, CBRE said.

Improvements in infrastructure will facilitate the movement of goods and drive demand for logistics space in Asia, as global manufacturers reassess their sourcing and production strategies in response to recent trade wars and the Covid-19 pandemic, according to CBRE’s international trade report.

Rising geopolitical tension has caused a shift toward deglobalisation in the Asia Pacific region. As the global economy becomes less integrated, it will likely result in relocations of manufacturing hubs closer to target markets and to those with more cost-effective and available labour pools. The recent disruptions have prompted companies to diversify supply chains throughout Asia in a multi-country strategy.

As a result of the pandemic, companies with an overdependence on one country or region may reassess their sourcing and manufacturing strategies. “We have seen some manufacturers moving away from centralised supply toward increased diversification,” said Desmond Sim, head of research, Singapore and Southeast Asia, at CBRE.

Countries that are already investing in new infrastructure and are more open to attracting industry likely will receive the lion’s share of relocations. CBRE also expects to see a shift in trade patterns with this growing focus on diversifying supply chains and production locations, Sim said.

This trend has already started. While China is the world’s largest export economy by value, China to US exports decreased 12.7 per cent in 2019, and total trade between the countries declined by $100 billion year-over-year.

Countries that have benefited from this shift include Taiwan and Vietnam, the fastest-growing trade partners with US. Total trade between the US and the Southeast Asian nations rose in 2019 by $18.7 billion and $9.1 billion, respectively. Countries outside Asia, such as Belgium, the Netherlands and France, have seen increased activity as well.

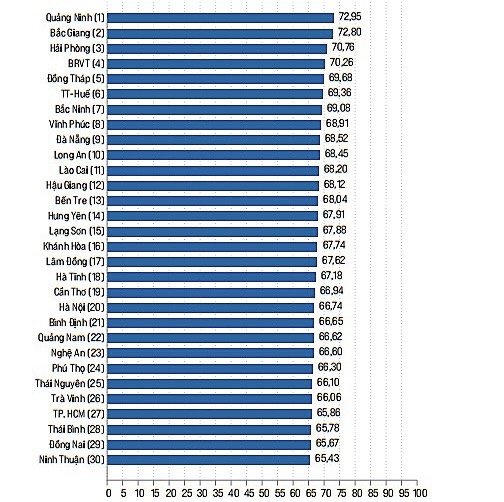

Despite rising trade protectionism worldwide, Vietnam continues to set new export records and has emerged as the next manufacturing hub. Exports increased an average of 16.8 per cent a year between 2010 and 2019. The country’s trade surplus last year totaled $9.9 billion.

The US – China trade conflict benefited Vietnam’s industrial property market in 2019 as manufacturers began shifting production to alternative markets. Average asking rents for industrial land in Vietnam increased by as much as ten per cent, with some industrial parks reporting rent growth of up to 40 per cent year-over-year.

While there are some barriers to entry, including a shortage of industrial land in prime locations and a lack of infrastructure in key areas, Vietnam’s manufacturing industry and industrial real estate market stand to benefit from the rapid changes in global trade and supply chains, as long as trade with developed countries remains a key growth driver.

In addition to infrastructure facilitating the movement of goods and driving demand for logistics space over the long term, CBRE also sees e-commerce growth changing warehousing demand in Asia Pacific. Total cross-border e-commerce sales in the region are expected to more than double to $389.5 billion in 2023 from $181.4 billion in 2018.

The integration of local supply chains likely will blend industrial and retail real estate, affecting the way goods are warehoused and delivered to consumers.

Bonded warehouses, which enable storage of goods without payment of duty, are increasingly popular amid rising consumer demand for imported products, as they facilitate faster delivery than direct shipping from the country of origin.

CBRE expects an increase in leasing demand for these warehouses, especially in large consumer markets such as China and India, and in cities with major ports and airports, such as Hangzhou, Shenzhen, Shanghai, Mumbai and Chennai.